- #Quickbooks self employed turbotax deluxe free how to#

- #Quickbooks self employed turbotax deluxe free update#

- #Quickbooks self employed turbotax deluxe free download#

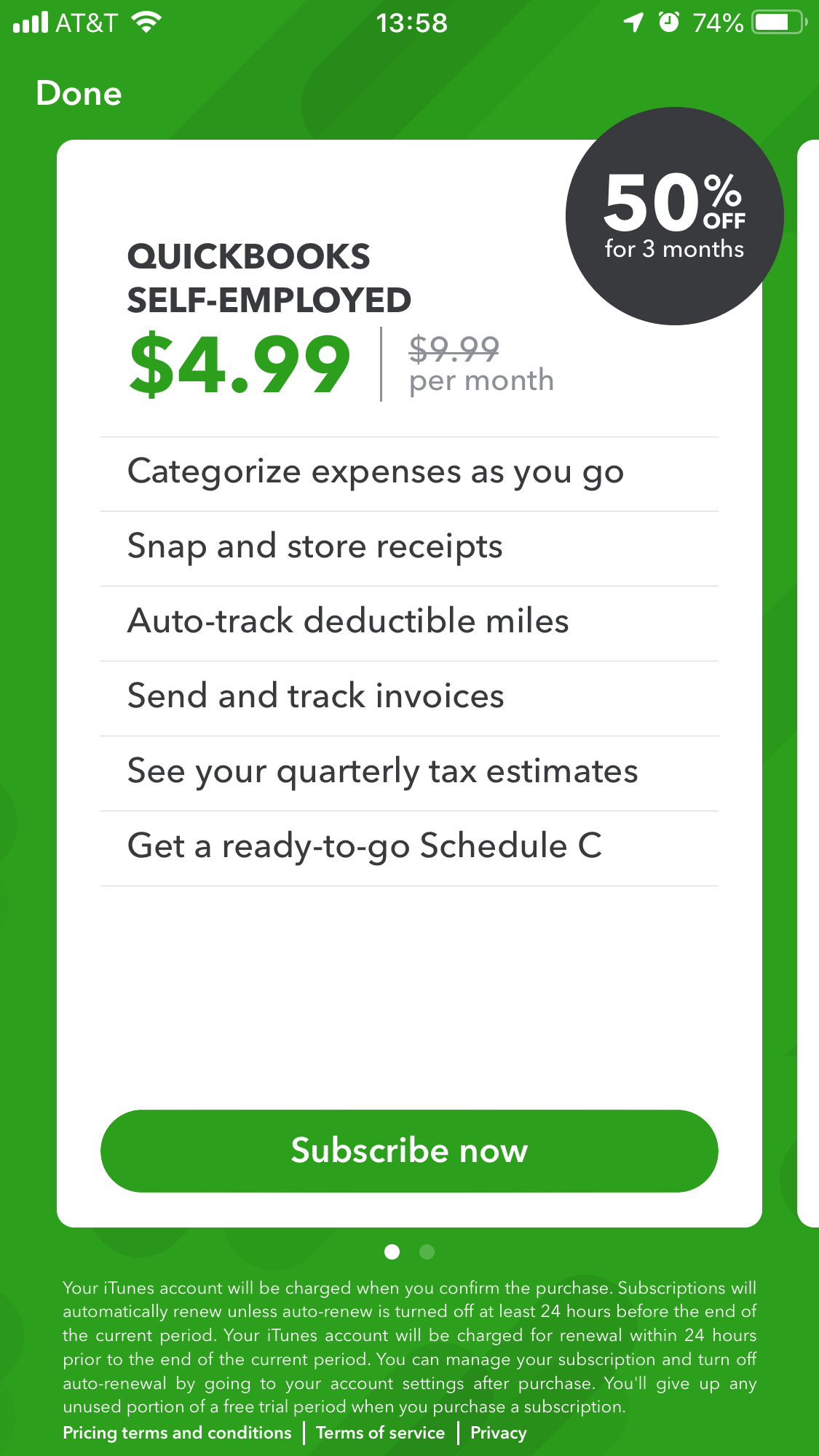

It has other features also which are given below: Like you can send and track simple invoices, have the access to monitor open invoices, clear overdue notifications. Surprisingly, it has a very low cost but still, it comes with lots of features. It comes at only $7.5 per month.įeatures included in QuickBooks Self-Employed Self-Employed is the most basic version of QuickBooks Self-Employed. Plans and Prices of QuickBooks Self Employed 1. QuickBooks Self-Employed LiveTax Bundle.There are basically three types of plans are available: Plans and Pricing Of QuickBooks Self-Employed Transactions for your Schedule C and annual tax return are also categorized by the QuickBooks Self-Employed. This will create an estimated amount to pay the IRS for taxes. Track Info: QuickBooks Self Employed record and categorize transactions and include them as a part of your federal estimated quarterly tax payments. You have to categorize them to correctly show up in the Schedule C category and on your financial reports.

#Quickbooks self employed turbotax deluxe free download#

It will automatically download your latest transactions. Put your expenses into the correct Schedule C and categorize transactions, and easily transfer Schedule C income and expenses.Īdd business transaction: You can easily add transactions into QuickBooks self-employed by just connecting your bank and credit card accounts to QuickBooks self-employed.

You Easily organize income & expenses for instant tax filing.įile taxes: Instantly transfer your financial data entry by connection to TurboTax Self-Employed. You can also snap a photo of your receipt and forward it directly from your mail.Įstimate taxes: With the automatic reminders of quarterly tax due dates you can avoid your late fees. Expenses are categorized automatically and you seamlessly enter your transaction information. Organize receipt: You can organize your receipt and keep it ready for tax time. Also, save time taxes by tracking all expenses in one place. Sort expenses: You can easily import expenses from your bank account directly and sort business from personal spending.

#Quickbooks self employed turbotax deluxe free how to#

#Quickbooks self employed turbotax deluxe free update#

How to Update QuickBooks Desktop to Latest Release.How to Turn On Online Payments in QuickBooks Desktop.How to Convert from Quicken to QuickBooks.How to Change Sales Tax Rate in QuickBooks.How to Stop, Delete or Cancel QuickBooks Online Subscription.How to Add a Pay Now Button & Payment Link to QuickBooks Desktop Invoice.How To Access QuickBooks Desktop Remotely.

0 kommentar(er)

0 kommentar(er)